What If Apple Made a Budget iPhone for India Priced at ₹20,000 INR?

This article explores whether Apple could create a ₹20,000 iPhone for India. It covers pricing challenges, the iPhone 5c lessons, the impact of Make in India and how a budget iPhone might compete with Chinese brands like Redmi, Realme, Oppo and Vivo.

TL;DR This article explores whether Apple could realistically create a ₹20,000 iPhone for India. It explains why iPhones remain expensive due to taxes, premium components and the cost of maintaining the ecosystem. It examines the failure of the iPhone 5c and how it shaped Apple’s reluctance to produce lower priced models. The article outlines what a budget iPhone might look like, the compromises required and the limited impact of the Make in India initiative on pricing. It also compares such a device with Chinese competitors and discusses why Apple might still consider entering the budget segment in the future.

Introduction

Understanding Why iPhones Cost So Much in India

The idea of a ₹20,000 iPhone is fascinating, particularly for the Indian audience that remains highly price conscious yet aspirational. To understand whether such a device could exist, it is important to recognise why iPhones currently command a higher price in the country. The first factor is the taxation structure that increases costs significantly before the phone even reaches store shelves. Import duties, GST and logistical charges collectively contribute to the final retail price. Additionally, Apple maintains a premium positioning and invests heavily in its vertically integrated hardware and software ecosystem, which increases production costs. These aspects set the stage for evaluating whether a budget iPhone could be possible. This section alone highlights the difficulty of making an affordable iPhone without compromising the company’s standards.

Role of Premium Components

Apple relies on high quality materials, precision manufacturing and custom silicon that is optimised for longevity. These are not inexpensive choices. Each component reflects Apple’s emphasis on reliability and design consistency, both of which are integral to its brand strategy. As a result, the company is not able to reduce costs in the same manner as many Android manufacturers who offer competitive specifications at lower margins. This quality driven philosophy means that an iPhone targeting the ₹20,000 mark would need substantial changes in materials or internal hardware. The consistent use of advanced components is why Apple products maintain performance for several years, but it also raises the base cost before taxes. In this sense, Apple India pricing remains a challenge.

Importance of the Ecosystem

Apple’s ecosystem includes software updates, cloud services, app optimisation and hardware support that functions reliably across the product lifespan. This model has long term benefits for users but is costly to sustain. Regular update cycles for older devices require significant engineering investment. Apple also ensures that even older models remain secure and functional for many years, which contributes to its premium identity. If a budget iPhone were to be produced, the company would still need to support it at the software level, making it difficult to lower the total operational and supply chain costs. This creates a substantial barrier in bringing a device to the budget smartphone India segment.

Apple’s Previous Attempt at a Less Expensive iPhone and Why It Failed

Before imagining a ₹20,000 iPhone for India, it is important to examine Apple’s earlier attempt at making a slightly more affordable device. In 2013, Apple launched the iPhone 5c as a colourful, lower cost alternative to its flagship models. Despite being positioned as fun and approachable, the product did not achieve the expected success. The iPhone 5c used a polycarbonate body and reused components from the previous generation, both of which reduced the production cost. However, the reductions were not substantial enough to appeal to budget conscious buyers, nor was the phone premium enough to attract typical Apple loyalists. This in between position contributed to its lack of strong market reception. The iPhone 5c became a reminder that pricing strategy is extremely delicate for a company built on high end perception. The device’s legacy influences Apple’s hesitation today in targeting the budget iPhone India category.

How the 5c Was Perceived?

Many consumers viewed the iPhone 5c as a downgraded version of the iPhone 5s, largely due to the materials used and the limited price difference between the two models. The polycarbonate shell, although durable, was considered less premium compared to the aluminium designs Apple was known for. Buyers in developing markets expected a significantly lower price that did not materialise. Consequently, the iPhone 5s overshadowed the 5c by a large margin. For Apple, this experience demonstrated that a lower cost iPhone must either be priced aggressively or feature a clear value proposition, neither of which was achieved with the 5c. This failure continues to influence Apple’s cautious approach to any affordable smartphone initiative.

Impact on Apple’s Strategy

The iPhone 5c reinforced the idea that Apple should not dilute its brand by attempting to compromise its design philosophy. Instead of creating low cost devices, Apple now focuses on selling older flagship models at reduced prices. This approach allows the company to maintain high product quality while offering customers more affordable entry points into the ecosystem. It also helps preserve Apple’s premium identity, which is central to its marketing and long term strategy. The experience with the 5c serves as a reminder of the risks involved in deviating from established brand expectations. This lesson informs Apple’s reluctance to enter the low cost smartphone segment directly, particularly in price sensitive markets.

What a ₹20,000 iPhone Would Look Like in India?

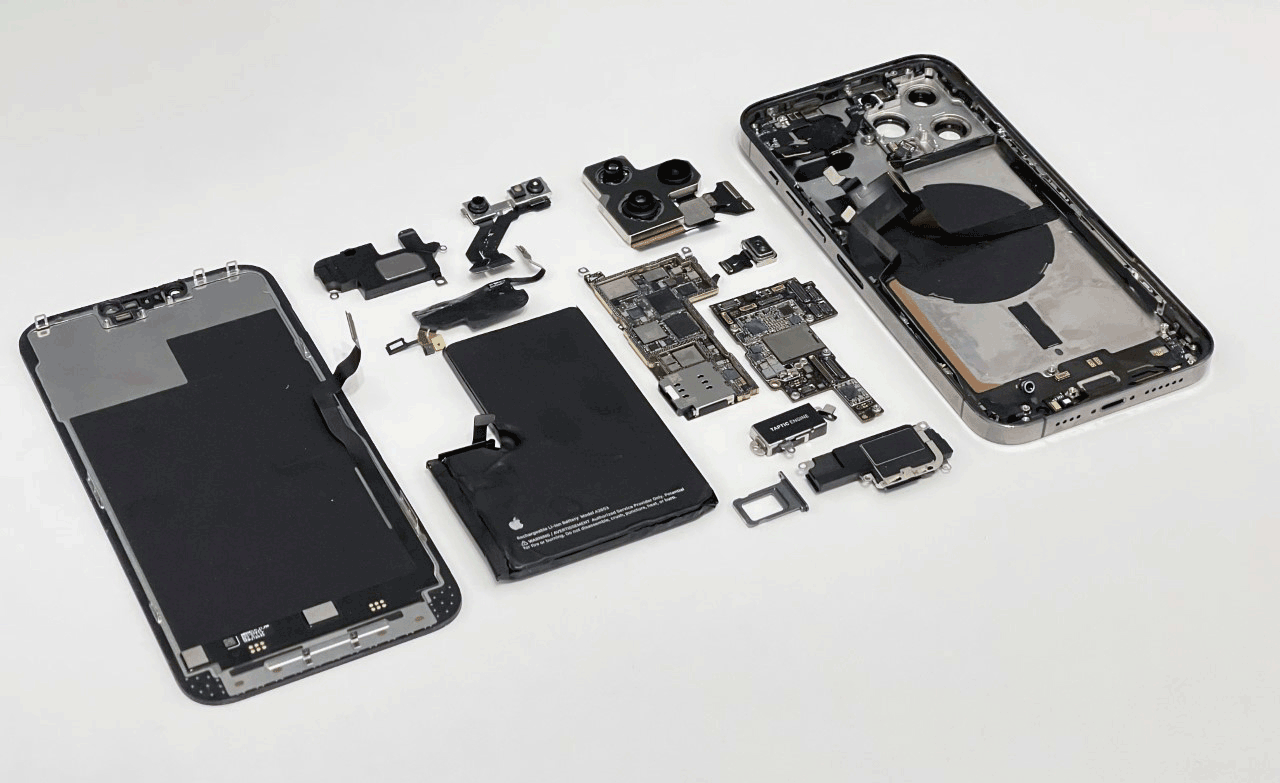

Creating a ₹20,000 iPhone for India would require a substantial redesign of Apple’s usual approach. The device would need to prioritise essential features while omitting premium elements that usually define the brand. A plastic or polycarbonate body might replace aluminium or glass to reduce manufacturing costs. Display technology would likely revert to LCD instead of OLED, allowing Apple to cut expenses while maintaining acceptable visual quality. The camera system would be simplified to a single lens, possibly with fewer software features. Chip selection would also require adjustments, possibly by using an older A series chip underclocked to balance performance and thermal control. Even with these reductions, Apple would need to manufacture the device entirely in India to avoid import duties. This strategy would help achieve the pricing goal, although it might still be challenging. The very idea highlights the complexities of entering the budget phone India market.

Design Compromises

A design focused on cost reduction would inevitably require Apple to make choices that differ from its usual premium approach. A plastic back would offer durability while reducing manufacturing complexity. The display might feature a lower refresh rate, and bezels could be slightly thicker to cut production costs. Despite these compromises, Apple would try to maintain visual consistency with the broader iPhone family to avoid alienating users. A simplified internal layout could also improve repairability, which may appeal to the Indian audience. Even with these changes, the product would still aim to deliver a distinctly Apple experience. These compromises underscore the difficulty in balancing cost with brand identity within the smartphone market India.

Hardware Expectations

A ₹20,000 price point would not support advanced camera arrays, high refresh rate screens or the latest processors typically associated with flagship iPhones. Instead, hardware would focus on reliability and efficiency. A single rear camera would allow Apple to offer consistent performance without complex sensor systems. An older chipset would reduce cost but still ensure adequate day to day performance due to iOS optimisation. Battery capacity might be slightly higher than usual to satisfy Indian consumers who value longevity. These choices would help Apple compete functionally while remaining within the target price. Such a device could appeal to first time iPhone users entering the Apple ecosystem.

Apple’s Make in India Initiative To Reduce iPhone Prices

Apple’s growing focus on local manufacturing in India has brought several operational advantages, but the reduction in retail pricing has been limited and gradual. The primary reason is that while assembling devices within the country helps avoid certain import duties, it does not eliminate all cost related challenges. Components are still imported, and their taxation continues to influence overall pricing. However, local assembly has allowed Apple to stabilise supply chains, reduce logistics related expenses and introduce newer models in India more quickly. These improvements have contributed to modest price adjustments over time, though not enough to transform the iPhone into a low cost product. As a result, the impact of Make in India has been meaningful yet not transformative for Apple India pricing expectations.

Why Prices Did Not Drop Significantly?

Although Make in India removes the duty applied to fully assembled imported phones, several other financial factors remain unchanged. Component level duties still apply, and Apple’s commitment to high quality hardware continues to keep base production costs elevated. Marketing, distribution and after sales service also contribute to the final retail price. These costs are difficult to reduce substantially, even when assembly shifts to India. Buyers may notice moderate price stability rather than dramatic reductions, which reflects the realistic impact of local assembly on the overall cost structure. For these reasons, Make in India has helpful but limited influence on affordable iPhone possibilities.

How a Budget iPhone Would Compete with Chinese Smartphones?

A budget iPhone entering the ₹20,000 segment would face a highly competitive environment shaped by brands that specialise in feature rich, aggressively priced devices. Chinese manufacturers dominate this price range by offering high specification hardware that appeals strongly to Indian consumers who prioritise visible value. These brands typically include multiple cameras, fast charging, high refresh rate displays and large batteries, all of which create a strong perception of worth. In comparison, Apple would focus on system optimisation, reliability and long term updates rather than raw hardware. This difference in strategy may create challenges when convincing buyers who are used to evaluating smartphones by feature counts rather than holistic performance. Both approaches cater to different priorities, which makes success in this segment uncertain for any budget iPhone India idea.

Spec Sheet Comparison

The table below compares what a hypothetical ₹20,000 iPhone might offer against typical devices from popular Chinese brands in the same range. The figures reflect common characteristics in this segment rather than specific models, and demonstrate how Apple would likely approach cost management.

| Category | Hypothetical Budget iPhone | Redmi (Typical 20k) | Realme (Typical 20k) | Vivo (Typical 20k) | Oppo (Typical 20k) |

|---|---|---|---|---|---|

| RAM | 3 GB or 4 GB | 6 GB or 8 GB | 6 GB or 8 GB | 6 GB or 8 GB | 6 GB or 8 GB |

| Camera Setup | Single rear lens | Triple or quad lens | Triple or quad lens | Dual or triple lens | Dual or triple lens |

| Display | LCD, 60 Hz | AMOLED or LCD, 90 Hz or 120 Hz | AMOLED or LCD, 90 Hz or 120 Hz | LCD or AMOLED, 90 Hz | LCD or AMOLED, 90 Hz |

| Battery | 2000 to 2500 mAh | 5000 mAh | 5000 mAh | 5000 mAh | 4500 to 5000 mAh |

| Charging | 10 W | 33 W to 67 W | 33 W to 80 W | 18 W to 44 W | 18 W to 33 W |

| Chipset | Older A series / Custom Low Performance Chips | Mid range Snapdragon | Mid range Dimensity | Mid range Snapdragon | Mid range MediaTek |

This comparison highlights that Apple would likely fall short in visible specifications, particularly in RAM, refresh rate and camera count. However, Apple’s optimisation often delivers smooth performance despite lower figures. Even so, many Indian consumers focus on specifications when assessing value, which places a hypothetical budget iPhone at a disadvantage in this price category. This creates a difficult environment for any device that does not participate in the value for money race.

Market Reception

Indian buyers frequently rely on comparisons between features and pricing when selecting smartphones. This behaviour benefits Chinese brands that excel at delivering impressive hardware at competitive prices. A ₹20,000 iPhone with modest specifications might struggle to attract mainstream interest unless it provides a clear advantage in areas such as reliability, longevity or software stability. Some consumers appreciate Apple’s consistent interface, ecosystem integration and long term updates, which may help the device appeal to a smaller but committed audience. However, the broader market prefers devices with standout specifications, making Apple’s challenge significant. To succeed, the company would need to position the product carefully and highlight its strengths in a way that resonates with the Indian smartphone market. This underscores the difficulty of entering the budget Android vs iPhone landscape.

Why Apple Should Consider Making a Budget iPhone?

Despite the challenges, there are compelling reasons for Apple to consider developing a more affordable device tailored to India. The country is one of the fastest growing smartphone markets globally and holds significant long term potential. By offering a lower priced iPhone, Apple could attract first time smartphone users seeking a reliable ecosystem. This would help increase the company’s market share and strengthen its position against competitors who already dominate the lower and mid tier segments. Additionally, Apple’s expansion of manufacturing facilities in India could support a more competitive pricing model. The company could use this opportunity to introduce more consumers to its ecosystem, which would eventually lead to increased revenue through services. These strategic advantages demonstrate why exploring the budget smartphone segment may be beneficial.

Strategic Importance of India

India represents a large base of young consumers who seek a balance between aspirational brands and affordability. This creates a unique opportunity for Apple to establish long term relationships with new users. Expanding market presence at the lower end of the price spectrum would allow Apple to compete more effectively against well established Chinese brands. The company could also leverage its growing manufacturing presence in India to reduce costs and create region specific product strategies. A thoughtfully designed iPhone priced for the local market could give Apple greater penetration and contribute to sustained growth. This makes the Indian market one of the most strategically significant regions for the Apple India strategy.

Long Term Ecosystem Benefits

One of Apple’s greatest strengths is its ecosystem, which encourages long term customer retention. If the company introduces a more affordable iPhone, it could bring many new users into this ecosystem. Once consumers adopt Apple services, such as cloud storage or music subscriptions, they are likely to remain within the ecosystem and upgrade to higher tier devices in the future. This long term revenue model aligns well with the company’s strategic direction and supports a sustainable growth path. In this context, a lower priced iPhone for India could become an entry point for millions of users. This highlights the long term value of an affordable iPhone initiative.

Conclusion

The concept of a ₹20,000 iPhone for India is compelling because it challenges the conventional understanding of Apple’s market approach. Although creating such a device would require significant compromises and adjustments, it could open new opportunities for Apple within a highly competitive market. The past failure of the iPhone 5c demonstrates the complexity of balancing affordability with brand identity, but changing market dynamics and India’s rapid growth may encourage Apple to explore new strategies. Whether such a device becomes a reality or remains a thought experiment, it raises important questions about pricing, consumer expectations and long term brand positioning. Ultimately, the appeal of a budget iPhone reflects the evolving nature of the Indian smartphone market and the possibilities that lie ahead.